OKADA CLOSED 2 OF TOP 10 RETAIL DEALS IN NYC

The top 10 NYC retail leases in February February’s top 10 retail leases were slightly higher than January’s in terms of square footage.

The 10 biggest deals signed last month totaled 108,184 square feet, up 13,536 square feet from last month’s total of 94,648 square feet. The largest deal inked in February was in Midtown. Here’s the full list:

1) T.J. Maxx, 250 West 57th Street, Midtown – 19,000 square feet

The discount retailer extended and expanded its lease for 19,000 square feet of retail space at 250 West 57th Street. T.J. Maxx now occupies 47,000 square feet in the Empire State Realty Trust-owned building, while Ripco Real Estate represented the tenant in the transaction.

2) SkyFoods Kissena, 41-61 Kissena Boulevard, Flushing – 14,519 square feet

The supermarket inked a lease for 14,519 square feet at 41-61 Kissena Boulevard. Daniel DePasquale of Winick Realty Group represented the tenant and the landlord, Flushing Plaza.

3) Alo Yoga, 241 Bedford Avenue, Williamsburg – 14,228 square feet

The yoga studio signed a lease for 14,228 square feet of retail space at 241 Bedford Avenue. Lauren Musacchio and Alissa Bersin of McDevitt Company represented the tenant. Jaime Schultz of Lee & Associates NYC represented the landlord, RedSky Capital.

4) Modell’s Sporting Goods, 1601 Kings Highway, Sheepshead Bay – 13,905 square feet

The sportswear store inked a 10-year lease for 13,905 square feet of retail space at 1601 Kings Highway. Josh Augenbaum of Augenbaum Realty represented the tenant, while Nick Zweig of Locations Commercial Real Estate represented the landlord, Kingsway Realty.

5) NoHo Hospitality Group, 80 South Street, Financial District – 11,000 square feet

The restaurant group signed a lease for 11,000 square feet on the first floor and the mezzanine level at Howard Hughes Corporation’s Pier 17 at 80 South Street. Robert Futterman, Joshua Strauss, Benjamin Zack and Spencer Levy of RKF represented the tenant and the landlord.

6) Sam Won Garden Artisanal Korean Barbecue, 37 West 32nd Street, Midtown South – 10,000 square feet

The Korean barbecue eatery inked a 13-year lease for 10,000 square feet at 37 West 32nd Street. Elad Dror and Tony Park of PD Properties represented the tenant and the landlord, ARX AA.

7) 36 H&Y Duet, 65 West 36th Street, Midtown South – 7,565 square feet

The karaoke place signed on for 7,565 square feet of retail space at 65 West 36th Street. Ryan Chong of R&E Realty represented the tenant. Richard Smith and Aaron Noorani of Winick Realty Group represented the landlord, 65 W 37 LLC.

8) Chloe + Isabel, 40 Exchange Place, Financial District – 6,517 square feet

The jewelry company inked a five-year lease for 6,517 square feet of retail space at 40 Exchange Place. Janet Pierce Duncan of Colliers International represented the tenant, while Allen Gurevich of GFP Real Estate represented the landlord in-house.

9) Tim Ho Wan, 610 Ninth Avenue, Hell’s Kitchen – 6,250 square feet

The restaurant signed a for 6,250 square feet of retail space at 610 Ninth Avenue. Christopher Okada of Okada & Company represented the tenant, while Hudson Real Estate represented the landlord, Youffousse 610 9th Ave Realty.

10) Bulldozer NYC, 135 West 52nd Street, Midtown – 5,200 square feet

The restaurant inked a five-year lease for 5,200 square feet of retail space at 135 West 52nd Street. Daniel DePasquale and Thomas Caliendo of Winick Realty Group represented the tenant, while Christopher Okada, David Ho and Francis Leung of Okada & Company represented the landlord in-house.

Cipriani Dubai's Restaurant Co Takes 129 W. 52nd Street

Okada & Company is proud to announce the successful lease up of the retail at 129 West 52nd Street, New York, NY. The 5,000 SF + property was leased to international hospitality company Bulldozer Group, which runs and operates dozens of restaurants and venues around the world including Tanuki Restaurant (60 locations), Cipriani Dubai, Socialista, VIP room and Movida. Tom Caliendo and Daniel DePasquale of Winick Realty Group represented the tenant, and the ownership Christopher Okada, David Ho, and Francis Leung represented themselves. The asking rent was $175/SF.

The retail property sits at the base of 135 West 52nd Street which is formerly the famed Flatotel. It was converted into a luxury mixed-use condominium project which includes 109 luxury apartments, office park, and a retail condominium. The developers Chetrit Group & Clipper Equities acquired the site in 2013 and began launching sales in 2015. Celebrated architectural firm Cetra Ruddy collaborated with French lighting designer Thierry Dreyfus to create a beautiful, upscale, and state-of-the-art living and working environment.

Okada & Company president Christopher Okada said "It took a lot of work, and we were negotiating with several groups, however, when I met and sat with some of the Bulldozer executives in Miami, I felt they were the right group and we issued leases shortly thereafter.... there's still a lot of work ahead."

Okada & Company CEO Featured In Leaders Magazine

Leaders Magazine interviewed CEO Christopher N. Okada about growth of the firm over the last 12 years.

Editors’ Note

Christopher Okada is a deal maker and entrepreneur. He rose to notoriety during the financial crisis of 2009 and its recovery by using the market’s lowered state to transact in nearly $1 billion in commercial real estate sales and leasing transactions in Midtown and Downtown Manhattan. It was also this time that he founded The Okada Acquisition Company to begin acquiring prime office, retail and multi-family properties in the Midtown and Midtown South submarkets of Manhattan.

Company Brief

Okada & Company (okadaco.com) is a multifaceted, progressive and full-service commercial real estate advisory and investment firm. With over four decades of New York City experience, Okada prides itself not only for accomplishing some of New York’s largest deals, but finding the value and the strategies needed for a successful transaction.

What was your vision in founding Okada & Company?

We are a generational family office. My father started in commercial real estate in 1969 and he was one of the only Japanese natives in commercial real estate.

The first people who started coming from Japan were small and medium-size restaurant companies and, in the ’70s, people weren’t eating sushi.

My father started with the tenant representation of Japanese companies and one thing led to another and we started representing Toyota Motor Company. He was one of the premiere brokers in the ’70s and ’80s during the golden era of Japanese interest. We became the thought leaders on real estate for the Asian community and this continued through the ’90s. By the mid-2000s, about 50 percent of the large Japanese corporations lost interest and many of them went to the West Coast or back to Tokyo.

I entered the business in 2002, shortly after 9/11, and started working as a broker for my father. Through the years, I trained with him as my mentor and then, in 2005, he told me he was interested in semi-retiring. I then started working on my own business concept. Instead of working only with Fortune 500 companies, I began to focus more on working with small and medium-size domestic companies.

We opened offices in January 2006 in the garment center. I represented small and medium-size tenants seeking office space in Midtown. When we began this new focus, the market was still hot but we were seeing certain areas of the country reach their peak. We saw growth in Manhattan all the way through to 2008, even though things were challenging.

During our first two years, it was literally a volume business. I would close several deals a month. There was no vision – our objective was just to make money and rent as much office and retail space as possible in the garment center. There was no romantic dream – it was about making a living.

I always imagined we would become landlords and own and manage our own properties, which we do today.

The circumstance that precipitated our move to the next level was that after Lehman Brothers collapsed and the economy was in a downward spiral in 2008, our phones stopped ringing. So, around the holidays in 2008, I reached out to people in all facets of commercial real estate. A good friend of mine, who was a mortgage broker, suggested that we had to go after distressed debt. He was kind enough to give me a crash course on that.

The first property we worked on was across from Macy’s, 960 Avenue of the Americas. A French bank had a $100 million mortgage but the building was completely vacant.

I found the appropriate people and represented a developer, who was acquiring many buildings in the immediate area. I called the developer with the opportunity to buy this property and launched our first venture into distressed debt.

This was the first $100 million transaction I had ever done with distressed debt. We went on to do $400 million more in the next year.

From 2009 to 2010, I did a little more than half a billion dollars in distressed debt, all in Times Square and Herald Square. That’s when I realized I knew how to find good deals and that it was time to put my money where my mouth was.

In 2011, it was the first year of the recovery and I found one deal I really liked, so I bought it and sold off certain parts. In my first transaction, we structured a land lease on a 115,000-square-foot office building across from the Empire State Building.

We have since acquired four properties and we’re trying to acquire our fifth, a condominium property. We also acquired two retail properties.

Property is becoming more expensive and it’s getting harder to find value. However, there’s a great opportunity today because people are very afraid of retail. People are very skittish about new condominium development as well, but I believe it’s important to be greedy while everyone is scared. To bet big on retail is scary because it’s going in the opposite direction of everyone else, but that is where we can find good deals.

Are you primarily focused on the same geography or has it broadened?

It has broadened. We now look from 57th Street to the World Trade Center. We have done several transactions Downtown on the brokerage side and portfolio side from Chelsea to Hell’s Kitchen. There are opportunities, but we need to go through different asset classes. It’s also harder to make money.

Is brand awareness important for you?

Branding is important. We really know the Midtown and Midtown South markets in all spectrums of commercial real estate.

How did your involvement with the upcoming real estate documentary come about?

That is part of brand awareness and external communications. I hired a videographer this summer and we were trying to come up with a program and marketing push that is more than typical e-mail and phone calls.

I wanted to push on visual content and digital marketing, and I didn’t like what we were producing.

We go through so much just being in Manhattan as New Yorkers, so the documentary addresses 9/11 to the financial crisis of 2008 and Hurricane Sandy. It talks about the boom and bust of commercial real estate and the tragedy and triumph of our industry and the City.•

RADIO NETWORK MOVES TO MIDTOWN

Okada & Company is pleased to announce the leasing of 363 7th Avenue of 3,400 square feet to tenant, Sun Broadcast Group. The asking rent of the space was $46 per square foot. The tenant has its headquarters in Boca Raton, Florida and will be moving it’s office from the Financial District to Midtown West. Ken Lerner, VP of Okada & Company represented the tenant, and Michael Segerman of Dynamic Real Estate Group represented the landlord, Empire Management.

Named one of the fastest growing companies in America by Inc Magazine three years in a row, Sun Broadcast Group is a national radio network reaching over 205 Million listeners through its more than 5,500 affiliates in both English and Spanish-language. Headquartered in New York City and Boca Raton, FL, Sun offers ad sales representation, syndication and programming support to producers, hosts and radio networks nationwide. It’s growing program and sales offerings includes the Sun Select RADAR® Network, The Hit List with Fitz, Slacker & Steve, Little Steven's Underground Garage, Shazam For Radio and many more.

Looking for similar space in Flatiron or Midtown/Downtown Manhattan? Please call us at 212-244-4240 ext. 305 or email at info@okadaco.com

Okada & Company is a multifaceted, progressive, and full service commercial real estate advisory and investment firm. With over four decades of New York City experience, Okada & Company has become the "go-to" in office and retail tenant representation.

THE NEW FASHION ENTREPRENEUR: What These Companies Are Doing To Buck Fashion Trends

Have you ever wondered how one restaurant is constantly busy, while another one across the street is empty? 2017 has been dubbed The Retail Apocalypse by many media outlets due to companies like Ralph Lauren, BCBG, Michael Kors, Guess, Abercrombie & Fitch, closing stores nationwide. As a commercial real estate advisor and developer of retail properties who’s worked with companies like The Gap, UNIQLO, MUJI, and Luis Vuitton, and long time deal maker in the fashion district, I can tell you first hand we’re seeing a shift in how entrepreneurs in fashion are conducting business and creating revenue.

Pop Up Shops: Pop up shops are truly the epitome of today’s feeling toward long term commitments. Why rent a space for a long period of time in a market that isn’t as low risk as it once was? Pop shops are that way to give the customer a limited amount of time to purchase an item in real time. It makes them feel obligated to buy it now before missing out on it. Companies save big time through this method and it gives them the option to only be in business for seasons and promotions they deem worthy. Kanye West’s Pablo, Kloe Kardashian’s Good American, Adidas, Check out this article on pop up shops here.

Online to Brick & Mortar: Yes, you’ve read that right. Not brick and mortar to online, that’s going the wrong way nowadays. To get your footing off on the right start: test the waters out as an online retailer. Build your loyal fan base, and become such a sensation that your customers are basically demanding you to actually open up shop. It’s working for brands like Everything But Water, Alo Yoga, and Bonobos.

Social Media: This is an obvious one isn't it? Yeah I’m sure you remember contests like the Instagram promotion by Sunny Co Clothing right? Repost and receive a free bathing suit, you just cover the shipping charges. It got thousands of reposts, but couldn’t exactly make due on its promise. This goes to show you, social media can turn you into an internet star in a matter of hours - just make sure you actually have the means when you incur such a high demand. Read the full story here.

Showroom Spaces: 212 Showroom located in the fashion district neighborhood in NYC. The company decided to create a space for designers to showcase their pieces. They then host at least 65 trade shows a year allowing designers the chance to be seen and give them the opportunity of being picked up by boutiques and retailers. This is a play on the real estate. Although fashion showrooms have been around for decades, this new wave of showrooms specifically choose and curate their designers for a specific audience or a specific group of buyers.

Collaborations: Supreme X Luis Vuitton, Supreme x Gucci, Fenty x Puma, Gigi Hadid x Tommy Hilfiger, KENZO x H&M etc etc. Brands today are coming together to really make something interesting for their shoppers. This not only allows brands (like Luis Vuitton) to either break into a completely different demographic or expand that fan base.

In times of transition and chaos, there are always any opportunities once you look past the problems. We’ve seen this in every financial crisis and every shift in consumer behavior. This is what we’re seeing as service providers to the fashion industry. Are you seeing any other trends?

Please like/share here!

INTERACTIVE ENTERTAINMENT COMPANY TAKES BOWERY RETAIL

International interactive entertainment company PanIQ Escape Rooms has brought it’s company to New York City for the first time. PanIQ has seven total locations throughout the US with two in Los Angeles, one in San Jose, San Francisco, Phoenix, Chicago, Washington D.C, and Miami.

David Ho of Okada & Company has represented PanIQ Escape Rooms in their company expansion to New York of 3,000 square feet at 290 Grand Street. They will be utilizing two store fronts on the ground floor as well as all of the lower level. The company is building its flagship unit in New York, with 5 interesting themes, like the Insane Asylum, Prison and Wild West. David Ho, who specializes in office & retail leasing has also previously worked with interactive entertainment, a specialized use group, in the past. He has also worked with Mystery Room NYC to find locations throughout the big apple. Nir Gilboa of Nolita Group represented the landlord.

Conceived in Hungary, and developed in the United States, PanIQ Escape Rooms has had 11 locations thus far in the United States, Europe, and Australia. Paniq Escape Rooms has started to sell franchise licenses this year, the company is one of the fastest growing escape room brand in the US.

Okada and Company is a multifaceted, progressive, and full service commercial real estate advisory and investment firm who specializes in tenant services, landlord services, and investment services. The company has over four decades of New York City experience.

Q3 2017 MANHATTAN OFFICE REPORT

HERALD SQUARE CHIROPRACTIC DOUBLES IT'S OFFICE SPACE

Okada & Company is pleased to announce the successful leasing of part of the 12th floor at 45 West 34th Street. The tenant, Herald Square Chiropractic & Sport doubled in size and took 3,154 SF. They relocated from the 8th floor in the building. Founding partner & principal chiropractic sport physician Dr. Chris Cueto wrote to his clients and staff..."With 4 years of service in Herald Square, we've observed a considerable amount of growth and demand that we have no choice but to open a bigger space to accommodate our patients; in fact double the current space" David Ho, Vice President of Okada & Company represented Herald Square Chiropractic, and Richard Price of EVO Real Estate Group represented the Landlord.

Looking for similar space in Midtown or Downtown Manhattan? Please call us at 212-244-4240 ext. 305 or email at info@okadaco.com

++++++++

Okada & Company is a multifaceted, progressive, and full service commercial real estate advisory and investment firm. With over four decades of New York City experience, Okada & Company has become the "go-to" in office and retail tenant representation.

++++++++

Keep In Touch!!!

Facebook: https://www.facebook.com/okadacompany/

Instagram: https://www.instagram.com/okada_nyc/

Twitter: https://twitter.com/OkadaCompany

MANHATTAN RETAIL VACANCIES DIP TO 3.8%

TRAVEL AGENCY SUBLEASES SPACE AT 1385 BROADWAY

July 31, 2017 - Ken Lerner, Vice President of Okada & Company has represented Sita World Travel in a sublease deal of a 1,590 square foot space with an asking price of $55 per foot at 1385 Broadway. This will be their third time working with Okada & Company. Evan Lieberman of EVO Realty Group represented the sublessor.

SMALL GIRLS PR TAKES OVER AOL SPACE

Okada & Company is pleased to announce the sublease of 6,900SF on the 11th floor at 150 West 22nd Street in the Flatiron section of Midtown South Manhattan. The tenant Small Girls PR is a New York-based digital agency that offers services such as digital PR and event production in its own creative way, earning Small Girls PR the status “a go-to buzz builder for tech & media companies and "one of the most successful boutique agencies in NYC" according to BuzzFeed. The sub-landlord is a subsidiary of internet giant AOL Inc.

Ken Lerner, Vice President of Okada & Company represented the tenant, and David Hollander, Executive Vice President of CBRE represented the sub-landlord.

++++++++

Looking for similar space in Flatiron or Midtown/Downtown Manhattan? Please call us at 212-244-4240 ext. 305 or email at info@okadaco.com

++++++++

Okada & Company is a multifaceted, progressive, and full service commercial real estate advisory and investment firm. With over four decades of New York City experience, Okada & Company has become the "go-to" in office and retail tenant representation.

++++++++

Keep In Touch!!!

Facebook: https://www.facebook.com/okadacompany/

Instagram: https://www.instagram.com/okada_nyc/

Twitter: https://twitter.com/OkadaCompany

MUJI USA DOUBLES FASHION DISTRICT OFFICES

Japanese Retail Company MUJI USA has expanded their NYC office of 6,250 Square Feet at 250 West 39th Street from their original 2,900 square ft. Catherine O'Toole & Gregory Gang of CBC Advisors represented the landlord.

Since 2007, MUJI has opened 17 retail locations thus far in North America bringing their worldwide tally to close to 700 stores. Christopher Okada also represented MUJI USA in the opening of their retail locations at 475 5th Avenue (North American Flagship), 54 Cooper Square (SoHo), 620 8th Avenue (NY Times Building), 16 West 19th Street (Chelsea).

"In 2017, retailers really need to focus on their online and retail user/customer experience. MUJI really has been focusing on this since their inception. I believe it's paying off in a big way these days.” Okada said.

LAW FIRM EXPANDS TO 45 WEST 34TH STREET

Nancy Burner & Associates, P.C. is a full service elder law firm concentrating in the areas of Estate Planning, Trust and Estate Administration and Litigation, Special Needs Planning, Guardianship and Elder Law. Headquartered in Suffolk County, the law firm is expanding it's practice to New York City with the acquisition of 1,996 SF at 45 West 34th Street. The asking rent was $57/SF.

David Ho of Okada & Company represented the tenant and Dana Moskowitz, Richard Price, and Robert Rosenberg of EVO Real Estate Group represented the landlord.

45 West 34th Street is a property acquired jointly with the principals of EVO Real Estate Group, Newmark Holdings, and Okada Acquisition Company in 2012. The property underwent a $15M gut renovation project, and is now 96% leased.

SWIM & RESORT FASHION COMPANY TAKES UNION SQUARE

New York, NY - April 25th, 2017 - Okada & Company is pleased to announce the successful lease of the retail at 3 East 17th Street Street in the Union Square section of Manhattan.

3 East 17th Street, NYC

The tenant, Everything But Water is a women's apparel company with over 100 retail outlets throughout the country. For over 30 years they've specialized in the sale of swim and resort fashion all year-round.

Everything But Water took 2,200SF of retail which is currently occupied by women's intimates company Journelle. The 10 Year lease was structured by David Ho & Francis Leung of Okada & Company who represented the landlord. RKF represented the tenant.

Okada & Company is a multifaceted, progressive, and full service commercial real estate advisory and investment firm. With over four decades of New York City experience, Okada & Company has become one

HISTORICAL MANHATTAN INVESTMENT SALES NUMBERS

Since we submitted our Q1 2017 numbers we've received numerous requests for a historical view on where we are. This is a quick snapshot and insight into what the first quarters looked like over the past 10 years.

Q1 2007: $17.2B

Q1 2008: $5.0B

Q1 2009: $1.5B

Q1 2010: $1.53B

Q1 2011: $3.1B

Q1 2012: $5.7B

Q1 2013: $5.5B

Q1 2014: $9.6B

Q1 2015: $16.7B

Q1 2016: $10B

Q1 2017: $4.58B

Q1 2007 - Q1 2017 ($Billions)

HELL'S KITCHEN CONDO PROJECT SELLS OUT

Okada Acquisition Company is pleased to announce the completion and sell-out of 55-unit residential condominium project 432 West 52nd Street. Sales of the 60,000SF development commenced in October, 2014. The project was also featured on Season 5 of Bravo TV's Million Dollar Listing New York.

Okada Acquisitions head Christopher Okada stated "I loved this deal. When we launched sales we wondered if we would miss the market. Six months from the launch, we owned it without any debt. The team and people involved were amazing, and it was featured on TV. It wasn't all rainbows and unicorns however. My father passed away 1 month after we purchased it (which was devastating) and from Q2' 2015 onward there was a lot more competition in the immediate area. I also clearly remember people doubting we could get the sales numbers we achieved. In the end, I'm really happy with the partnership, the talented people involved, and the process in general."

MANHATTAN RETAIL VACANCIES HIT 4.1%

The New York City retail market experienced a slight decline in market conditions in the first quarter 2017. The vacancy rate went from 3.8% in the previous quarter to 4.1% in the current quarter. Net absorption was negative (54,419) square feet, and vacant sublease space increased by 12,981 square feet. Quoted rental rates increased from fourth quarter 2016 levels, ending at $89.86 per square foot per year. A total of 3 retail buildings with 114,528 square feet of retail space were delivered to the market in the quarter, with 2,381,590 square feet still under construction at the end of the quarter.

Net Absorption

Retail net absorption was slightly negative in New York City first quarter 2017, with negative (54,419) square feet absorbed in the quarter. In fourth quarter 2016, net absorption was negative (37,262) square feet, while in third quarter 2016, absorption came in at positive 560,933 square feet. In second quarter 2016, negative (157,549) square feet was absorbed in the market.

Tenants moving out of large blocks of space in 2017 include: Room & Board moving out of 30,500 square feet at 105 Wooster St; and Harlem NYC moving out of 30,000 square feet at 256 W 125th St.

Tenants moving into large blocks of space in 2017 include: Bed Bath & Beyond moving into 20,361 square feet at 5 W 125th St; TJ Maxx moving into 20,000 square feet at 5 W 125th street and Bed Bath & Beyond moving into 20,000 square feet at 2431 Broadway.

Vacancy

New York City’s retail vacancy rate increased in the first quarter 2017, ending the quarter at 4.1%. In prior quarters, the market has seen an overall increase in the vacancy rate, with the rate going from 3.7% in the second quarter 2016, to 3.5% at the end of the third quarter 2016, 3.8% at the end of the fourth quarter 2016.

The amount of vacant sublease space in the New York City market has trended up over the past four quarters. At the end of the second quarter 2016, there were 44,053 square feet of vacant sublease space. Currently, there are 88,375 square feet vacant in the market.

Largest Lease Signings

The largest lease signings occurring in 2017 include: the 47,286-square-foot-lease signed by Nordstrom Rack at 855 Avenue of the Americas; the 39,821-square-foot-deal signed by Target at 111 W 33rd St; and the 30,045-square-foot-lease signed by Town Sports International at 2 Astor Pl.

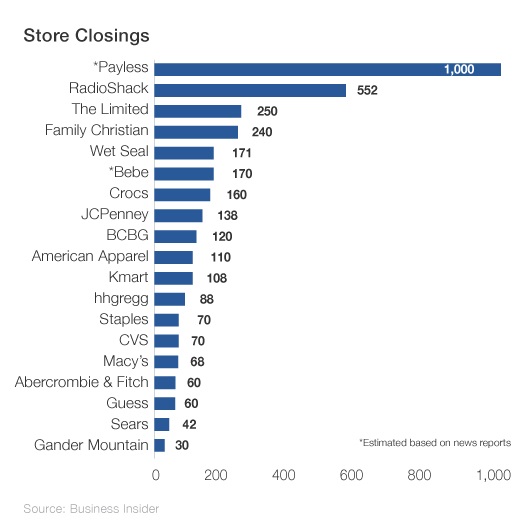

Nationwide Store Closings

Over the next 2 quarters several big chain retail companies have annouced the closing of over 3500 retail outlets throughout the country.

MANHATTAN OFFICE LEASING ACTIVITY UP 27%

Q1 2017 MANHATTAN OFFICE LEASING

4 World Trade Center

Year-Over-Year the office leasing activity increased by approximately 27.63% in Q1 2017 in Manhattan's main business districts. Although there was a negative net absorption of 1.65 million square feet, compared with Q1 2016's negative 2.28 million square feet, there was 630,000SF of more leasing activity.

Although there was more activity the overall vacancy rate increased to 8.4% by the end of the first quarter. Comparatively, the vacancy rate was 8.2% at the end of the fourth quarter 2016, 8.2% at the end of the third quarter 2016, and 8.1% at the end of the second quarter 2016.

Class-A projects reported a vacancy rate of 9.4% at the end of the first quarter 2017, 9.2% at the end of the fourth quarter 2016, 9.5% at the end of the third quarter 2016, and 9.4% at the end of the second quarter 2016.

Class-B projects reported a vacancy rate of 7.4% at the end of the first quarter 2017, 7.3% at the end of the fourth quarter 2016, 6.9% at the end of the third quarter 2016, and 6.8% at the end of the second quarter 2016.

Class-C projects reported a vacancy rate of 5.8% at the end of the first quarter 2017, 5.4% at the end of fourth quarter 2016, 5.1% at the end of the third quarter 2016, and 5.3% at the end of the second quarter 2016.

The Financial District and World Trade Center area had its best quarter in two years. Leases including Spotify’s 378,000 square foot lease at 4 World Trade Center, brought the area to 2.3 million square feet of activity. This is 44 percent above the quarterly average since 2007.

In areas of Midtown South where activity is usually highest among tech and advertising firms, rents increased 11.7% to an average of $76.65 per square foot. Downtown rents dipped 2.2 percent to $56.45 per square foot, while Midtown rents crept up 1.1 percent to $75.78 per square foot.

There are about 11.7 million square feet worth of new office space expected to hit the market in Manhattan through 2020. Half of that space is committed.

MANHATTAN INVESTMENT SALES DOWN 50%

1 Vanderbilt

In the first quarter of 2017, Manhattan commercial real estate sales transactions were down about 50% compared to the same time in 2016. The market has been anticipating this slow down for some time, however, it comes as a big surprise that the numbers would be so drastic.

Recapitalization transactions and equity investments took center stage as 60 Wall Street and 1 Vanderbilt found new partners. Both transactions were foreign Asian capital sources, namely GIC from Singapore and National Pension Service of Korea respectively.

Not only was the total volume of sales transactions down, the number of deals were down 26%, and the average price per deals were down 32%. All indications point to a lackluster quarter, and a slow start to commercial real estate sales throughout the city.

Okada & Company founder Christopher N. Okada believes "...it's a perfect storm of the city's lack of incentivizing development through 421-A programs [which may have just been revived], the financial institutions lending restrictions from laws like Dodd-Frank, a rise in interest rates, a gap between what sellers are expecting and what purchasers are willing to take, and simply put a cooling of a red hot recovery... we knew it was coming. I guess the big question is; what's the next right move?"

CLICK HERE FOR THE MARKET REPORT